VA Home Loan Credit Score | Requirements 2025

In addition to providing your current financial information and checking your VA eligibility, you’ll need to prove that you have a decent enough credit score to qualify for a VA home loan.

Your lender pulls your credit score during the application process. While there are a number of factors, your score could determine whether or not you qualify — and, if you do, what your interest rate will be. The lower your interest, the more money you can save over the life of the loan.

It’s often best to know your credit score and address any issues on your credit report before reaching out to lenders. That said, every lender is different and each has its own rules on minimum credit score requirements.

Here’s everything you need to know about credit scores and VA home loans.

See if your credit score makes you eligible for a VA home loan. (May 14th, 2025)How do credit scores affect VA loans?

One of the biggest impacts your credit score has on your home loan is determining what mortgage rate you’ll get.

Mortgage rates aren’t the same for everyone. Factors like the size of your down payment, debt-to-income ratio, in addition to your credit score all factor into the different interest rates that are available. Lenders have what’s called a rate sheet — essentially a chart that indicates the specific interest rate that can be offered to homebuyers based on the specific criteria mentioned above.

Spoiler alert: The higher your credit score and down payment amount, the lower the interest rate you’re eligible for.

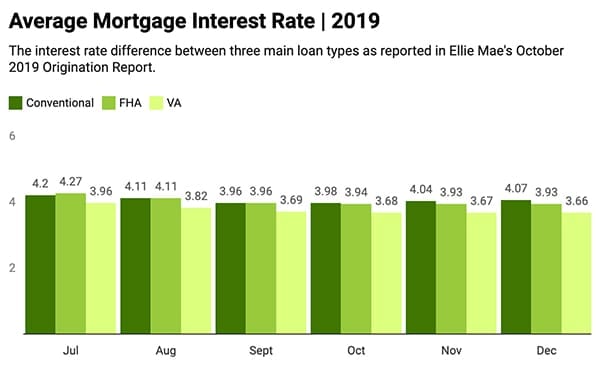

Some homebuyers may be concerned that making a lower down payment will force their mortgage rate higher. And, while it’s true that lower down payments can lead to higher rates, VA home loan rates are consistently lower than interest rates for other loan types even with a low down payment.

If you can’t (or don’t want to) make a large down payment, keeping your credit score healthy is the best way to get the lowest rates.

Source: Ellie Mae’s Origination Report, November 2019

What is the minimum credit score for VA loans?

The VA doesn’t require a minimum credit score for VA home loans. That said, every lender has its own underwriting requirements and may require specific minimum scores in order to approve a loan. If you have a credit score of 620 or higher, then you should be able to qualify for a VA home loan with most lenders.

Of course, there are always exceptions to the rule, but homebuyers should approach lenders when their credit score is as high as possible. If you’re almost there, say, a credit score of 580, then it’s probably worthwhile to work on your credit and raise your score.

| Credit Score | Category |

| 800 or higher | Exceptional credit |

| 740-799 | Very good credit |

| 670-739 | Good credit |

| 580-669 | Fair credit |

| Under 580 | Poor credit |

Getting a VA loan with poor credit

VA homebuyers with a credit score below 620 should work with a lender to find out how they can qualify. Usually, this means bumping up your credit score.

Your credit score fluctuates — for better or worse — and improving your score takes time. But, that doesn’t mean everyone with bad credit (500-550) is out of luck. There may be a few quick, smart decisions that can help you achieve a higher score.

Similarly, a decision at the wrong time can cause your credit score to drop. For example, if during the home loan application process, you purchase a new car or open a new credit card, then expect a quick drop in credit, which can negatively affect your loan application.

5 Ways to Improve Your Credit Score

- Pay your bills on time

- Pay off your debt and keep credit usage low

- Open new credit accounts only as needed

- Don’t close unused credit cards

- Dispute inaccuracies on your credit report

In addition to speaking with a lender on how to get approved, work to pay off any debt (credit cards, car payments, etc), avoid getting any new loans or credit cards, and always pay all of your bills on time. Doing so, will increase your credit score over time.

Can you be denied for a VA loan?

Yes. Although VA loans are intended to make homebuying accessible to veterans, loan applicants must meet both VA minimum eligibility requirements as well as any requirements specific to the individual lender to receive a VA loan.

Credit scores and VA refinances

The VA streamline refinance (IRRRL program) is among the easiest refinances to get approval for. However, even with refinances a low credit score can hurt your chances.

If you’ve been turned down from a lender for a refinance loan, then ask the lender why. Credit scores, combined with home equity and your debt-to-income ratio, determines your rate and eligibility. Sometimes increasing your equity amount or improving your debt-to-income ratio is all that’s needed. If the issue is a too low credit score, then working to increase your score is the best course of action.

Related: VA Cash-Out Refinance Rates, Guidelines, & Limits

Checking your eligibility

If you’re interested in getting a VA home loan or refinance a current one, but aren’t sure if your credit score is high enough, then you should speak to a lender. They’ll be able to tell you what rates are available to you with your current credit score and what you can get if you improve your score.

Get connected with multiple lenders today. (May 14th, 2025)