5 Refinance Tips That Can Save Veterans Up To $53,000 Starting In 2025!

Many homeowners are afraid to refinance.

It’s sad, but true.

They are often intimidated by the process. But the benefits are too big to ignore.

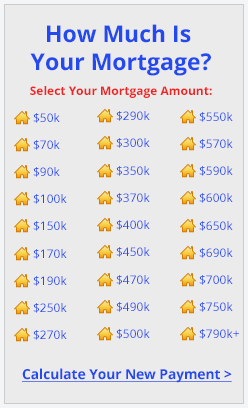

VA mortgage rates are at historical lows. Now is the time to lock in your rate. Even a modest jump in interest rates can have big consequences when applied to loans as large as a home mortgage. For example, consider the cost of waiting too long and having VA interest rates rise by a mere one percent. The difference between a 30-year, fixed-rate mortgage of $250,000 at 4% APR and one at 5% APR is nearly $150 per month and more than $53,000 over the life of the loan!

Fortunately, if you have a VA loan already, the process is easier — and less confusing — than for most homeowners. A VA-to-VA refinance is the key to eliminating the hassle.

And that’s exactly what the little-known VA Streamline loan does for you.

The VA Streamline Refinance gives the most to veterans and here’s why…

1. Refinance with Ease. A VA Streamline loan is also known as the Interest Rate Reduction Refinance Loan (IRRRL), because veterans can lower their rate and monthly home payment quickly and easily.

The veteran has already been approved for their first VA loan; now they can get a , lower interest rate, without going through the full approval process again.

2. No appraisal necessary. As long as a veteran already has a VA loan, they do not need to go through the process of an appraisal. This means that even if a homeowner owes more than what their house is worth, they can still be approved because no one will know the current value of the home.

**TIP: the VA homeowner ALSO does not need to sign up for mortgage insurance because bankers believe that since the loan is with the federal government, it is a lower risk. This makes the approval that much easier!

3. No hassling with paystubs, bank statements, or tax returns. When a VA homeowner wants to refinance their home, there is no need to go through the process of checking pay stubs or bank statements or tax returns! This means that as a VA homeowner you can qualify if a spouse or co-homeowner has become unemployed or if there’s a reduction in family income.

4. Quick Closing. With a VA- VA Streamline loan the closing process is quick. You can get your new rate and be paying less monthly in weeks, not months.

5. Dive into low VA rates. Right now, general mortgage rates are extremely low, and VA loan rates are even lower. The government backs these loans, so banks can lend at an ultra-low interest rate. With this information in-mind, those who have a VA loan can expect to lock in extremely low rates.

** Let’s re-cap the secrets a VA homeowner can TAP into…

- No appraisal necessary

- No mortgage necessary

- No income documents necessary

- A quick closing

- Low VA rates

READY TO SAVE?

Start Here >>>Sign up for our newsletter and get a

reminder to come back later.